Western Digital reportedly in advanced talks to merge with Kioxia

In brief: The chip shortage has accelerated the consolidation of the semiconductor industry, leading to a massive wave of mergers and buyouts. Western Digital is only the latest visitor to consider such a motion, and its optics are set on Kioxia, its longtime partner in making 3D NAND.

If you lot thought Nvidia purchasing Arm would forever alter the semiconductor landscape, you wouldn't be incorrect—we're talking about a $40 billion deal that doesn't involve fries. What it does involve is blueprints for RISC chips used throughout the tech industry to design custom silicon for a variety of uses. Then there's AMD'southward $35 billion acquisition of Xilinx, which adds important capabilities to the quondam and further consolidates the semiconductor industry.

However, there'southward been another big deal brewing in the background that made some splashes today. Western Digital is reportedly in advanced talks to merge with Kioxia Holdings Corp in a deal valued at over $20 billion. The conquering would mark a major shift in the flash storage industry. Manufacturers take been under enormous force per unit area over the last few years to deliver faster storage, higher flake densities, and all of it at high volumes and turn a profit-margin-eroding lower prices, leaving fewer opportunities for smaller companies to abound.

Western Digital has had its eyes on the Japanese visitor for some time. Back in 2022, when Kioxia spun off from Toshiba's burning business group, Western Digital was willing to pay as much every bit $18.2 billion, but Toshiba rejected the offer at the time. Fast forward to today, and Western Digital is valued at over $19 billion while Kioxia is getting ready for an IPO. Micron, who until recently was a potential bidder, decided the thought is too wild and dropped all discussions of a merger.

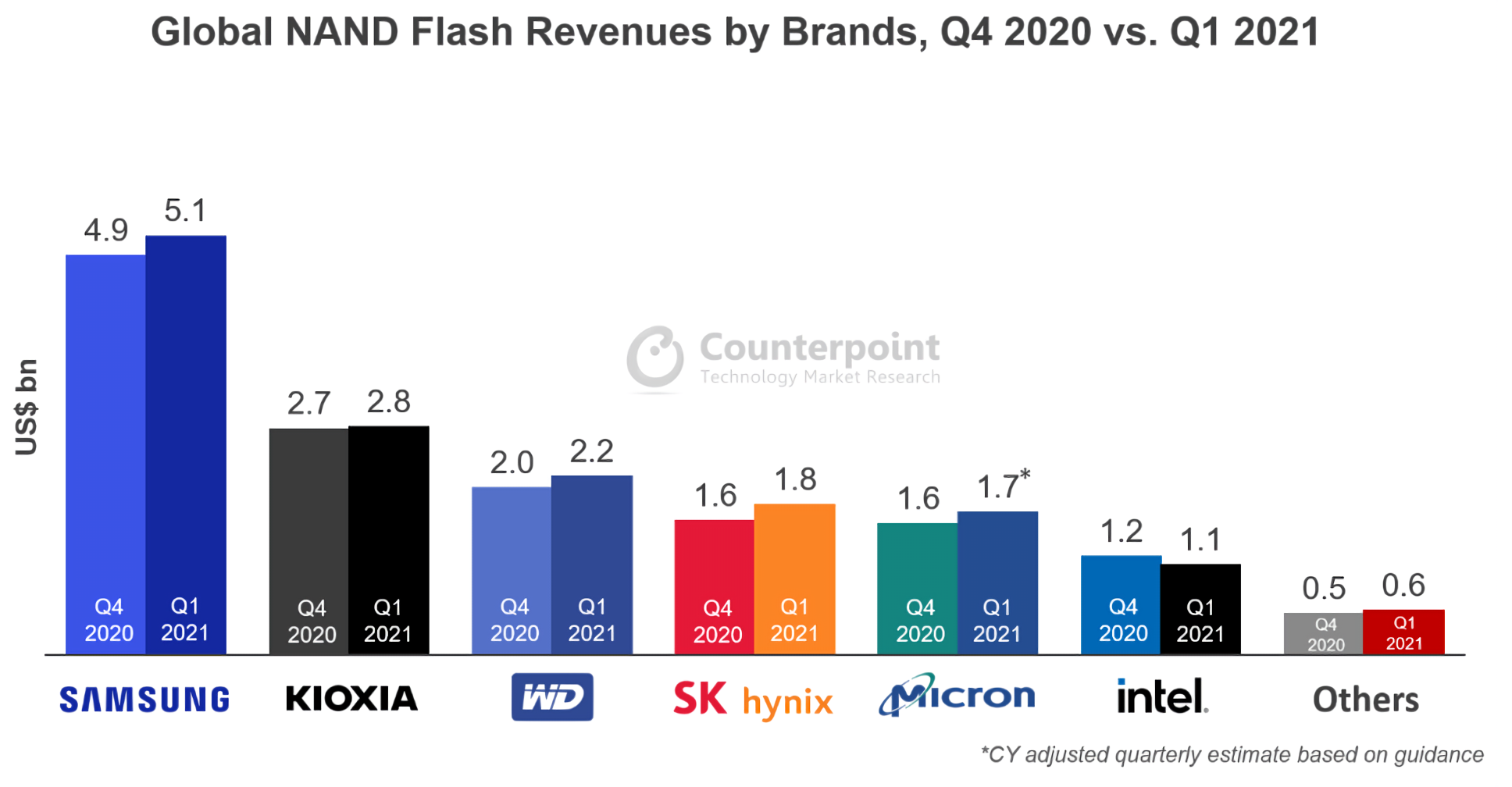

That leaves only Western Digital, which has a xx-year history of working with Kioxia on various projects, the most recent of which is persistent retention. At the same time, Western Digital CEO David Goeckeler told Nikkei during a recent interview that "we have a tremendous partner in Kioxia, and we await forrad to making the time to come happen together." Furthermore, he rightly pointed out that when you combine Western Digital and Kioxia's market positions, you lot end up with a behemothic the size of Samsung, with the potential to get even larger over fourth dimension.

Even if the deal doesn't materialize, the ii companies still have a strong partnership with articulation ventures around 3D NAND manufacturing, such as a factory in Yokkaichi and another in Kitakami, Japan. With SK Hynix ownership Intel'south NAND business, a merger between Western Digital and Kioxia is looking increasingly worth information technology.

Source: https://www.techspot.com/news/90951-western-digital-reportedly-advanced-talks-merge-kioxia.html

Posted by: andersonwhishis.blogspot.com

0 Response to "Western Digital reportedly in advanced talks to merge with Kioxia"

Post a Comment